Draft: 3/18/2017

Data Source: Kimly Offer Document

It is rather difficult to get offer document (I don’t know

why it is called prospectus for mainboard counter in SG, but is named as offer

document for Catalist counter).

Popular counter is hard to get. 'kosong' for me.

UOBKH earns 3% underwriting commission. Pg 30.

Pre-IPO: Issued and paid-up capital: $40,406,916 comprising

980,986,732 shares.

IPO: New shares to be issued: 173,800,000.

Post-IPO: Total shares:

1,154,786,732.

(IPO price, values Kimly at $288m)

(IPO price, values Kimly at $288m)

=========================================

Kimly business: operate drink stalls, lease food outlets to

tenants, provide cleaning services with 26 years of experience.

Statistics:

64 food outlets, incl. 56 coffee shops, 3 industrial

canteens, 5 food courts (in tertiary institutions), of which 121 self-managed

stalls, and 1 central kitchen.

Dim Sum stalls

|

43

|

Mixed Vegetable Rice

stalls

|

36

|

Seafood “Zi Char” stalls

|

29

|

Rice Garden stalls

|

10

|

Teochew Porridge stalls

|

2

|

Live Seafood restaurant

|

1

|

98% occupancy over 500 stalls, 5.8% market share (950 food courts

at Sep 2015)

Mr. Lim Hee Liat, Exec Chairman, 42.42% of enlarged capital

after IPO.

There is a contingent liability (aggregate dividend $11m)

payable to then-existing shareholders within 5 business day after trading.

Growth strategy: establish more food outlets in Singapore.

Dividend policy: intend of no less than 50% of NP.

=========================================

Short term risks

- Revenue pressure: Loss of bid of Ngee Ann Polytechnic food court, meaning reduce of business (only 5 food courts controlled by company, 20% loss), although compensated by an additional Tampines coffee shop mgmt. contract.

- Service agreement cost: low threshold set for sharing of profit by exec directors, criteria on PBT starting from 15m, when actual PBT in FY2016 is already 25m

- Cost pressure: tax increase, pre-IPO effective tax rate was 5%, much lower than SG’s statutory corporate income tax of 17%, FY2016 tax is 1.3m, if that is to be doubled, another outflow of 1~2m.

FY2014

|

FY2015

|

FY2016

|

|

@17%

|

3,607

|

4,005

|

4,349

|

Effective tax

|

1,160

|

1,067

|

1,365

|

(Pg A-34)

- Cost pressure: 7m central office/kitchen renovation, of which 5m will be from IPO proceedings

- Contingent liabilities: $11m dividends to be paid to existing shareholders

=========================================

Long term risks

- Master lease agreement with LHL companies, 17 out of 64 food outlets are controlled by Exec chairman(interested person), which are not injected as non-current assets into listed entity, Company in turn lease these from Mr. Lim’s personal company on 4+4 years’ term, rental currently standing at 649k mthly. While there are measures in place to keep an unbiased image of transaction, it is nonetheless a weak point in corporate governance no matter what IFA(independent financial adviser) and IV(independent valuer) states in Offer document, in addition it creates a backdoor for future interest transfer out of the Company, causing a potential damage to the interests of public shareholders and minority shareholders, no matter how non-prejudicial it seems right now.

FY2014

|

FY2015

|

FY2016

|

34,443

|

38,579

|

67,533

|

Pg A-32, it is stated that Commitment with Related Parties in next 5-y (lease) is:

FY2014

|

FY2015

|

FY2016

|

4,619

|

3,102

|

31,161($6m/p.a.)

|

<does that mean 46% of the lease

commitment of the Group from 2016 onward will be from Related Parties? which is not included inthe listed asset/entity>

- Furthermore, Company is seeking a deemed approval from shareholders on this IPT(Interested Person Transaction) Mandate by IPO application, and will seek such approval in future general shareholder meetings.

- The reason of not injecting such assets into the listed entity is unknown, my guess is: a) it could dis-proportionally increase Mr. Lim’s share in the listed company to the level void Catalist list criteria; or b) there is no price agreement on these assets in lieu of IPO shares from Mr. Lim and the rest of the entity owners.

Thus the listed entity comes with an asset light biz model,

owns no coffee shops.

(copyright: 联合早报)

Median size of new Catalist listings in 2015 is $160 million

Jumbo Group Ltd (SGX: 42R)

listed in Nov 15, IPO $.25, $40m, first day $.34(highest $.395), CAGR 2012-2014

is 34.2%, serving 6000 customers, 1.4 tonnes of crabs daily

=========================================

Financials

Profit & Loss

Revenue by Segment

(It seems that Food retail revenue is always 50% of Sales of food, drink and tobacco, could be just an intentionally selected accounting % to balance Food retail segment from that of Outlet mgmt segment)

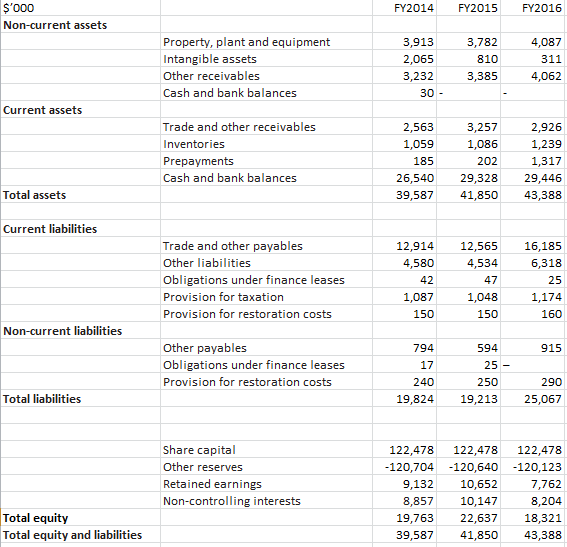

Balance Sheet

Cashflow

=========================================

Plan

I'm willing to accumulate some Kimly shares if the first day price is below $0.xx, but it is very likely traders(consider strong SG coffee shop culture) are going to push it above my limit. Given the short term/long term risks listed above, I'll probably become a bystander on first day of its trading (2017/3/20).

Cannot believe Kimly opened at 0.55.

ReplyDelete