Data source: from various internet sites, such as Yahoo!, shareinvestors.

ComfortDelGro is a local favorite. Writing anything on it will likely attract some strong objections from either side of the camp.

A few of local bloggers which I followed, in this year, have loaded with this counter upon its recent price weakness. It got me interested too, but to predict future price movement is always a difficult thing, even if not unachievable task. (用中国话来说,是一个容易“被打脸”的事情)

I didn't read all its annual reports before putting down the following analysis, so the assessment is purely mathematical, without a deep business understanding of its competitive environment, future aspect, market price improvement initiatives, or mgmt. effort on unlocking values for shareholders.

I just applied some simple(similar) rules taught by the 'master', from what I recently read.

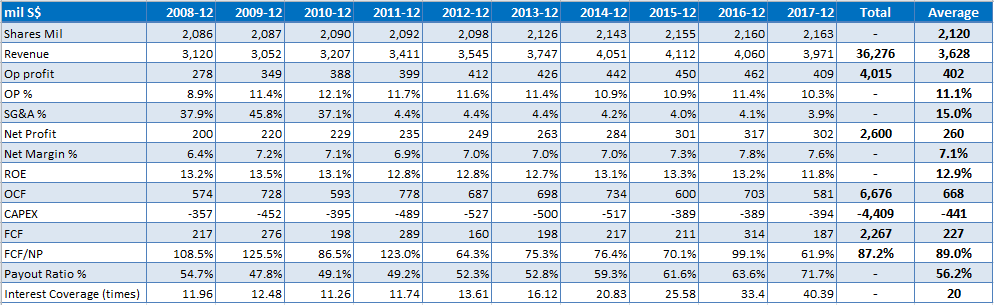

Financial Info of ComfortDelGro for last decade

ComfortDelGro business is fairly consistent,easy to analyze.

Its revenue is growing at an annualized pace of 2~3%, by observing the history record, its revenue seems increased every 3 years, then kept there for a while, then got another jump, probably related to taxi fare adjustment allowed by gov every few years.

Given the control of government on taxi tariff level, balancing of its profitability vs. general public's affordability, I think this pattern will continue. With the current road traffic loading, as well as general public's ridership behavior will not change drastically, the revenue projection of this counter can be estimated with certain level of confidence.

Its SG&A cost is quite consistently at 4% in recent years, I don't think it will swing too much either in the near future.

Over 10-y average, NI % is 7.1%, ROE 12~13%; FCF/NP is ~90%, meaning the quality of earning is pretty real. Interest coverage is 20 times, it is a safe company in term of financial health.

Over a 10-y horizon, it earned 2.6B net profit, 2.3B FCF in aggregation: or 260m$ NP, 230m FCF annually (on average).

I ask myself:

Well, may be yes, may be not:

Assessment

To me, even it dropped from $2.7+ in Apr 2017, to $2 now, it doesn't look like a bargain as it appeared at the first sight.

Caveats, with its gov-link background, similar to SPH etc, it might have a lot of hidden gems(assets), which cannot be simply analyzed by just putting up such a summary table, a serious investor has to thoroughly review its whole potential by reading each year's report and analyst reports.

For me, as a full time employee in other business lines, this is enough time spent on this counter, at least to give a pass, even if those gems can be found later, I'll, at least for now, don't feel being too tempted.

Catalysts:

- M&A(w/ internet ride hailing company)?

- AI driver?

2018.04.09

P.S. It is very time consuming to keep on blogging. I really admire the persistence of some of the well-know SG bloggers.

ComfortDelGro is a local favorite. Writing anything on it will likely attract some strong objections from either side of the camp.

A few of local bloggers which I followed, in this year, have loaded with this counter upon its recent price weakness. It got me interested too, but to predict future price movement is always a difficult thing, even if not unachievable task. (用中国话来说,是一个容易“被打脸”的事情)

I didn't read all its annual reports before putting down the following analysis, so the assessment is purely mathematical, without a deep business understanding of its competitive environment, future aspect, market price improvement initiatives, or mgmt. effort on unlocking values for shareholders.

I just applied some simple(similar) rules taught by the 'master', from what I recently read.

Financial Info of ComfortDelGro for last decade

ComfortDelGro business is fairly consistent,easy to analyze.

Its revenue is growing at an annualized pace of 2~3%, by observing the history record, its revenue seems increased every 3 years, then kept there for a while, then got another jump, probably related to taxi fare adjustment allowed by gov every few years.

Given the control of government on taxi tariff level, balancing of its profitability vs. general public's affordability, I think this pattern will continue. With the current road traffic loading, as well as general public's ridership behavior will not change drastically, the revenue projection of this counter can be estimated with certain level of confidence.

Its SG&A cost is quite consistently at 4% in recent years, I don't think it will swing too much either in the near future.

Over 10-y average, NI % is 7.1%, ROE 12~13%; FCF/NP is ~90%, meaning the quality of earning is pretty real. Interest coverage is 20 times, it is a safe company in term of financial health.

Over a 10-y horizon, it earned 2.6B net profit, 2.3B FCF in aggregation: or 260m$ NP, 230m FCF annually (on average).

I ask myself:

- Here is a business which is allowed to adjust its price level at 2~3% annually(on average), if I was a potential buyer of such business with 250k profit per annum , maybe I'm willing to pay 2m~2.5m? what about 4.5m asking price, is that too high or too low?

- Ok, maybe increase a bit, a business offer 300k profit per annum, is 3.6m(to acquire it w/o even counting all the debts yet) a reasonable price tag?

Well, may be yes, may be not:

- Because its dividend yield is 5%(2018/04/09, based on Yahoo! Finance info), I'm satisfied w/ this, since it is much better than SGD time deposit

- Because it offers ROE 12% @ PB 1.72 at current $2.09/piece, much better than a lot of other SG counters, it is not priced unreasonably inflated

- Because it has very few competitors? Its business volume is more or less guaranteed for foreseeable future

Assessment

To me, even it dropped from $2.7+ in Apr 2017, to $2 now, it doesn't look like a bargain as it appeared at the first sight.

Caveats, with its gov-link background, similar to SPH etc, it might have a lot of hidden gems(assets), which cannot be simply analyzed by just putting up such a summary table, a serious investor has to thoroughly review its whole potential by reading each year's report and analyst reports.

For me, as a full time employee in other business lines, this is enough time spent on this counter, at least to give a pass, even if those gems can be found later, I'll, at least for now, don't feel being too tempted.

Catalysts:

- M&A(w/ internet ride hailing company)?

- AI driver?

2018.04.09

P.S. It is very time consuming to keep on blogging. I really admire the persistence of some of the well-know SG bloggers.

No comments:

Post a Comment